Stop Guessing, Start Planning. Your Step-by-Step Guide to Buying a Home.

Everything you need to know about the process, the programs, and the numbers—all in one place.

Hi, I'm Ed the Realtor

A little about me:

I've been selling real estate in the Metro Atlanta areas for over 7 years now, helping hundreds of families along the way. I have extensive background in helping first time home buyers, investors, sellers, and relocations, specializing in the Gwinnett, Fulton, and Cobb county areas. If you are looking for someone to guide you through the entire process step by step and provide you the best real estate experience, then I'm your guy. I look forward to working together!

If You're Looking To Buy A Home But Have No Idea where to start, I've got you.

On this page, there are 2 main sections:

Buying Process

Loan Qualifications

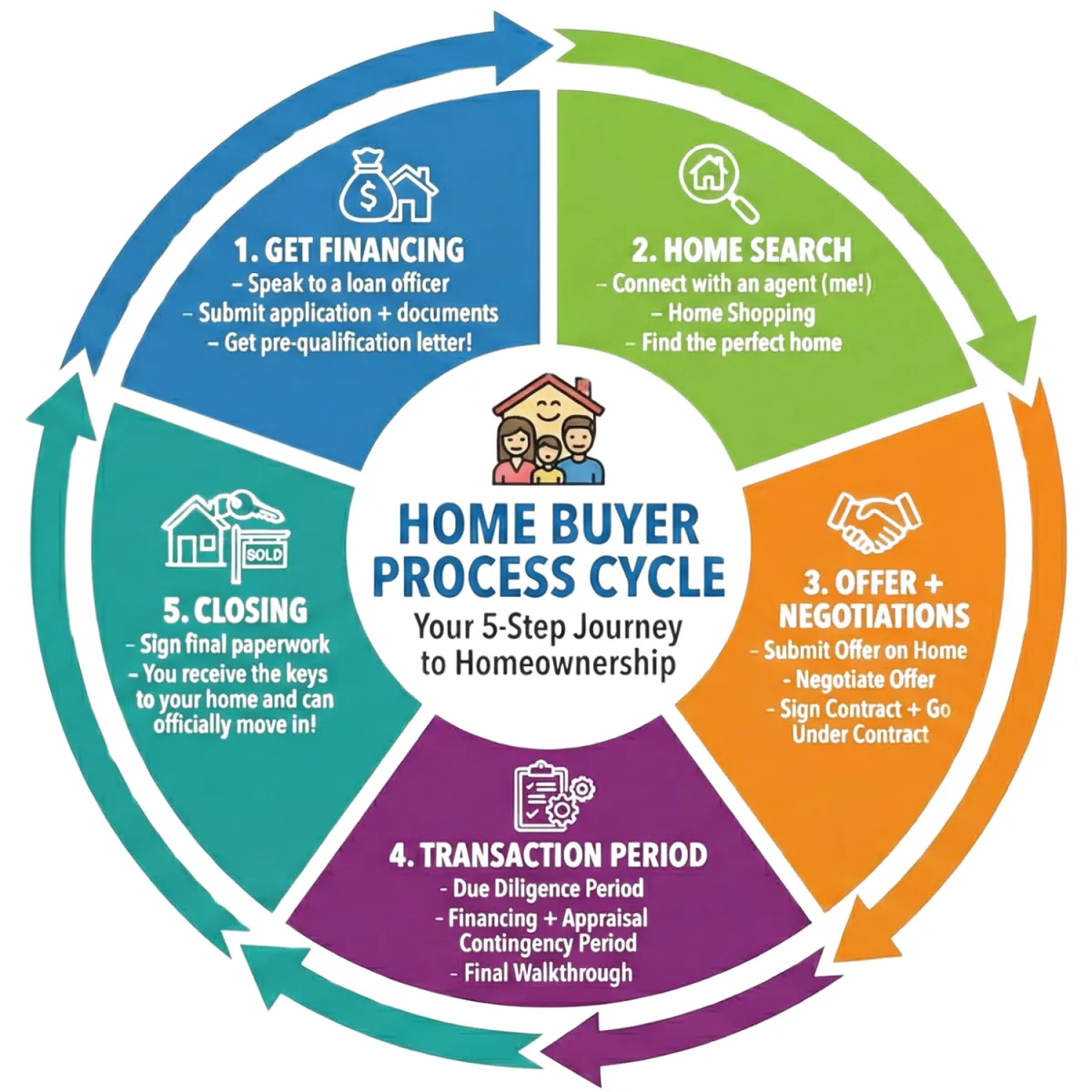

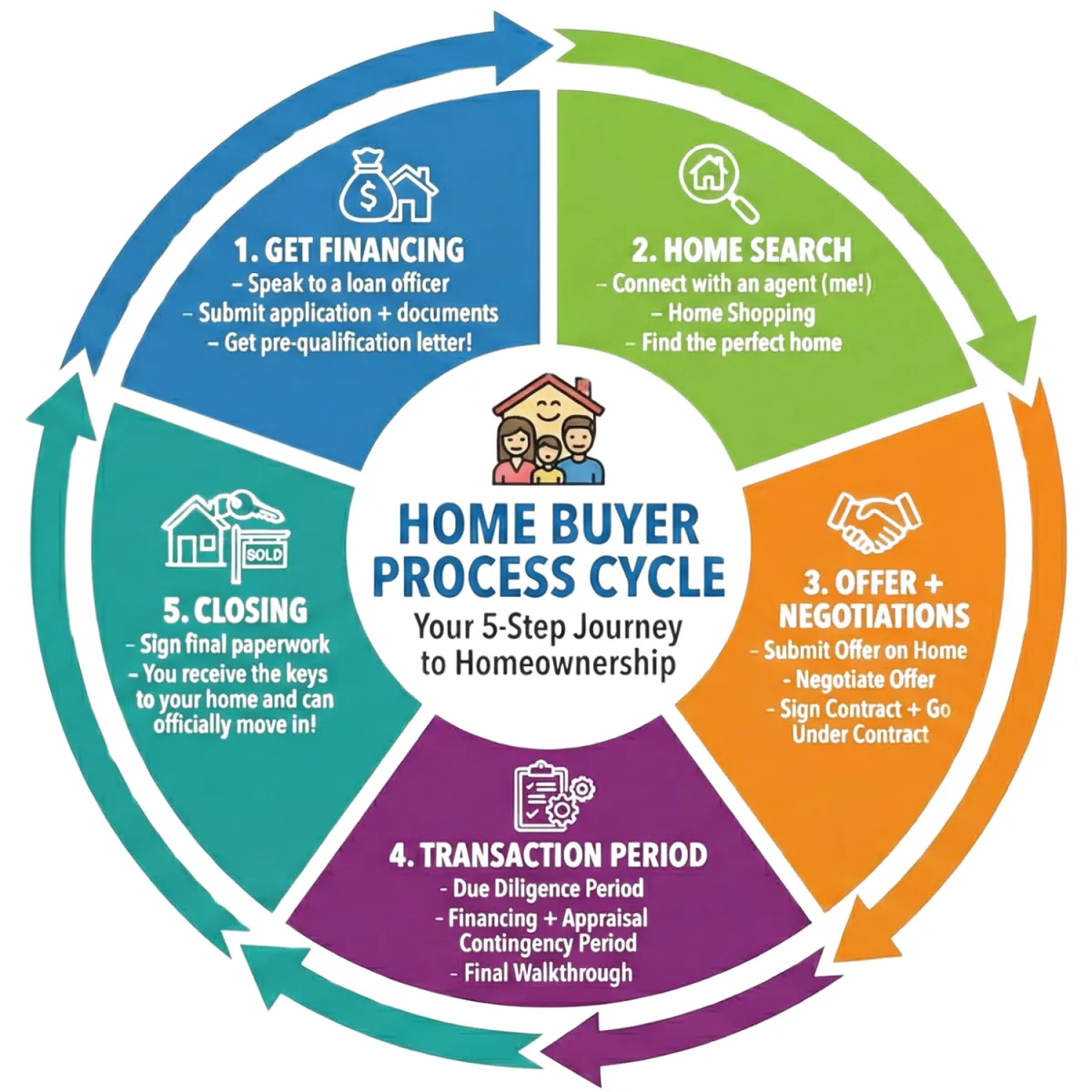

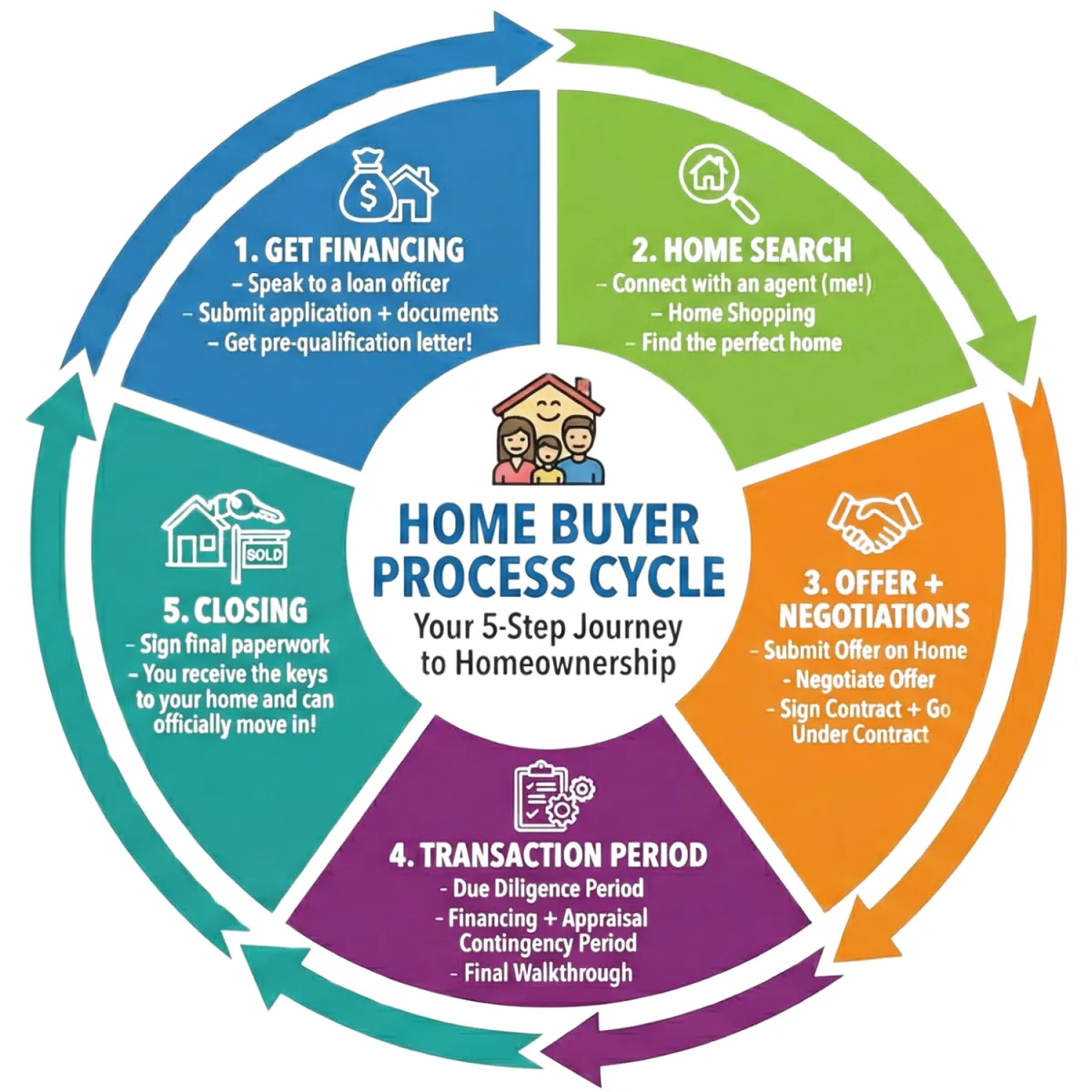

Take a look at the home buyer process cycle infographic to get a visual understanding of the home buying process. Next, take a look at the key loan qualification factors that are important to lenders. I will dive deeper into each section as you scroll below. The details will provide you a solid foundation to stand on and equip you with the confidence to take the leap on your home buying journey!

Please keep in mind, everyone's situation is different, as is every transaction. Though the home buyer process generally is the same, there will be additional items to know that will be specific to your situation. I have handled a variety of different scenarios and am ready to help you with yours!

Let's get started. Please make note of the info below ⬇️

*Information is for educational purposes only. I am a licensed Real Estate Agent, NOT a Mortgage Lender. Rates and terms are subject to change based on market conditions and credit approval. All scenarios are unique and must be run by a mortgage professional for more accurate information.*

FIRST: BUYING PROCESS

What does the home buying process look like?

The home buying process may seem daunting. Here is a visual breakdown of what you can expect. Below the infographic you will find each step broken down in more detail.

Step 1: Get Financing

FIRST: Speak to a loan officer

- I work with some of the best loan officers in the industry that specialize in every loan type. I am always happy to connect you with my partners. Upon connecting, you will have a brief consultation with them so they can understand your situation and needs.

SECOND: Submit application + documents

- After speaking with the loan officer, they will send you an application link to complete the application.

- Once the application is complete, they will need supporting documents. They will need different documents depending on your employment status and loan type. As a starting point, you can expect to submit income documents (i.e. W2's, paystubs, tax returns, etc.) and 60 days bank statements.

THIRD: Get pre-qualification letter!

- Once the loan officer has reviewed your application, your documents, and has obtained a credit report, they will send you a pre-qualification letter with an approval amount. Then, you are ready for step #2 below!

Step 2: Home Search

FIRST: Connect with an agent (me!)

- Once we have your pre-approval letter, this is where I step in to start working for you as your Realtor!

- I will conduct my own consultation with you to get an idea of exactly what you are looking for in your next home.

SECOND: Home Shopping

- Once we establish the exact home you are looking for, we are ready to tour homes.

THIRD: Find the perfect home

- Once we find you the perfect home, we are ready to submit an offer. I will explain to you the entire transaction process from start to finish from here on out. We are now ready for step #3 below.

Step 3: Offer + Negotiations

FIRST: Submit Offer on Home

- To write an offer on a home, there are many things to consider. Here are a few important items we will be choosing in an offer:

- Purchase Price: This is the price we are offering to pay for the home.

- Seller Paid Closing Costs (With your loan, you will have closing costs. We can ask for the seller to pay YOUR closing costs.)

- Closing Attorney + Closing Date (Typically, we select a closing date 30 days out from the offer date. Most transactions close in this time frame.)

- Due Diligence Period (This begins once the seller accepts our offer. More details below.)

SECOND: Negotiate Offer

- Once we send the offer to the seller, the seller can either accept, decline, or negotiate the offer. Typically, the seller chooses to negotiate.

THIRD: Sign Contract + Go Under Contract

- Once we come to terms, we sign the contract. Upon all parties signing the contract, we are officially 'Under Contract' on the home. We have in a sense "reserved" the home. Nobody else during this time can go under contract on the same home as you.

- Now, we enter the transaction phase of the process. Let's look at Step #4 below.

Step 4: Transaction Period

FIRST: Due Diligence Period

- Immediately upon going under contract on a home, we begin the due diligence period. Here are the 3 most important things that take place:

- Inspection: Besides a general home inspection, you can also order a mold, radon, sewer line, termite, and other inspections.

- Earnest money: It is essentially a "security deposit" and it is 1% of the purchase price of the home.

- Negotiate repairs: Once we receive the inspection report(s) back, we can negotiate critical repairs. We typically will focus on 'high-ticket' items such as foundational issues, roof, HVAC, water heater, structural issues, and/or health and safety hazards.

SECOND: Financing + Appraisal Contingency Period

- These periods also begin once we go under contract. Typically, they last 21 days from the contract date and protect your earnest money if your loan is denied or the appraisal value comes back too low.

THIRD: Final Days Until Closing

- We will perform a final walkthrough of the home a day or two prior to closing.

- You will wire the remainder of your funds (down payment + closing costs) to the closing attorney about 2-3 days before closing.

Step 5: Closing

CLOSING TIME!

- Once all paperwork is completed by all parties, we can officially close.

- We schedule a time to sign final paperwork at the closing attorney's office. Closing typically takes about an hour.

- Once everything is signed and the loan has been funded, we are finished. You receive the keys to your home and can officially move in!

SECOND STEP: LOAN QUALIFICATIONS

What Do I Need To Get Started To Get A Loan?

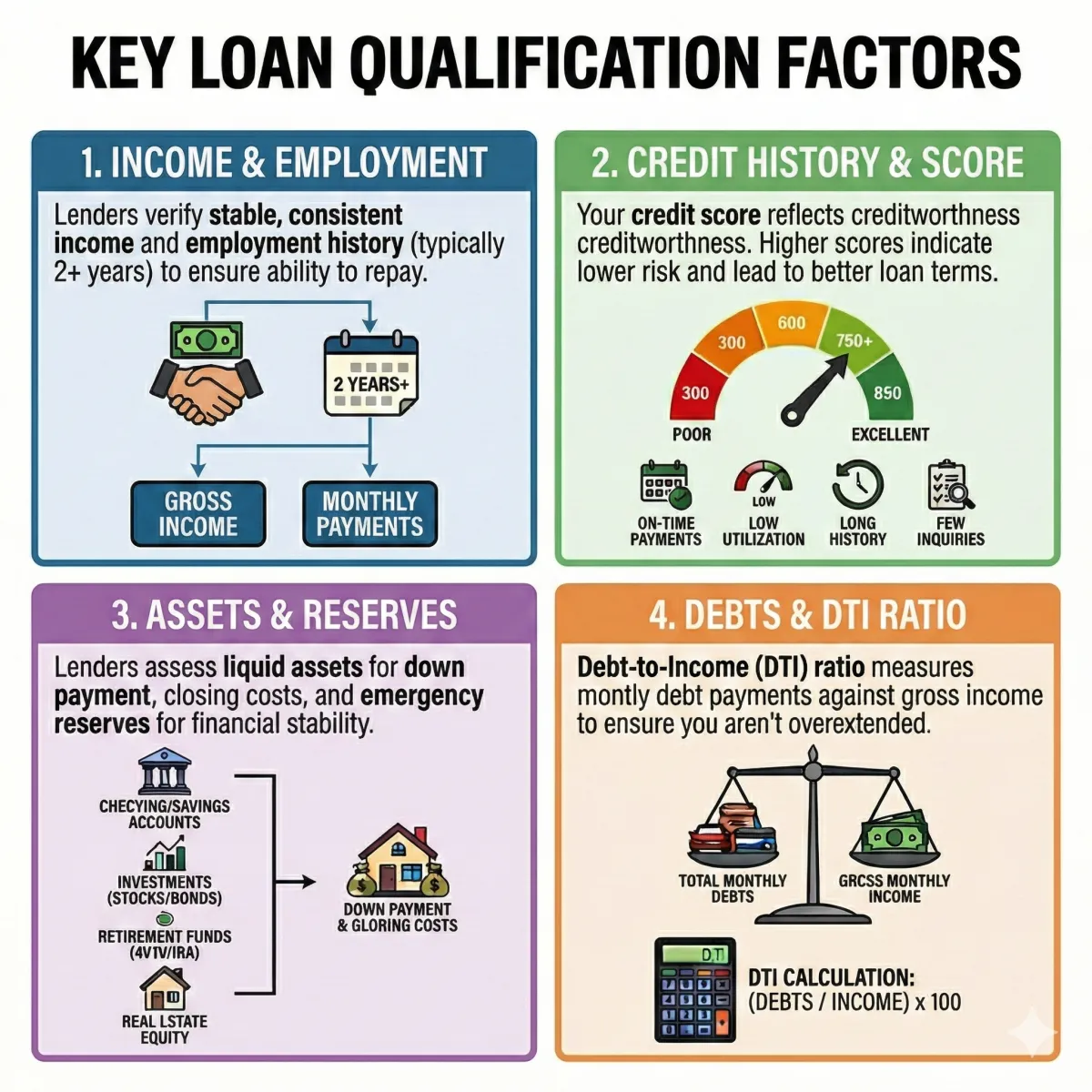

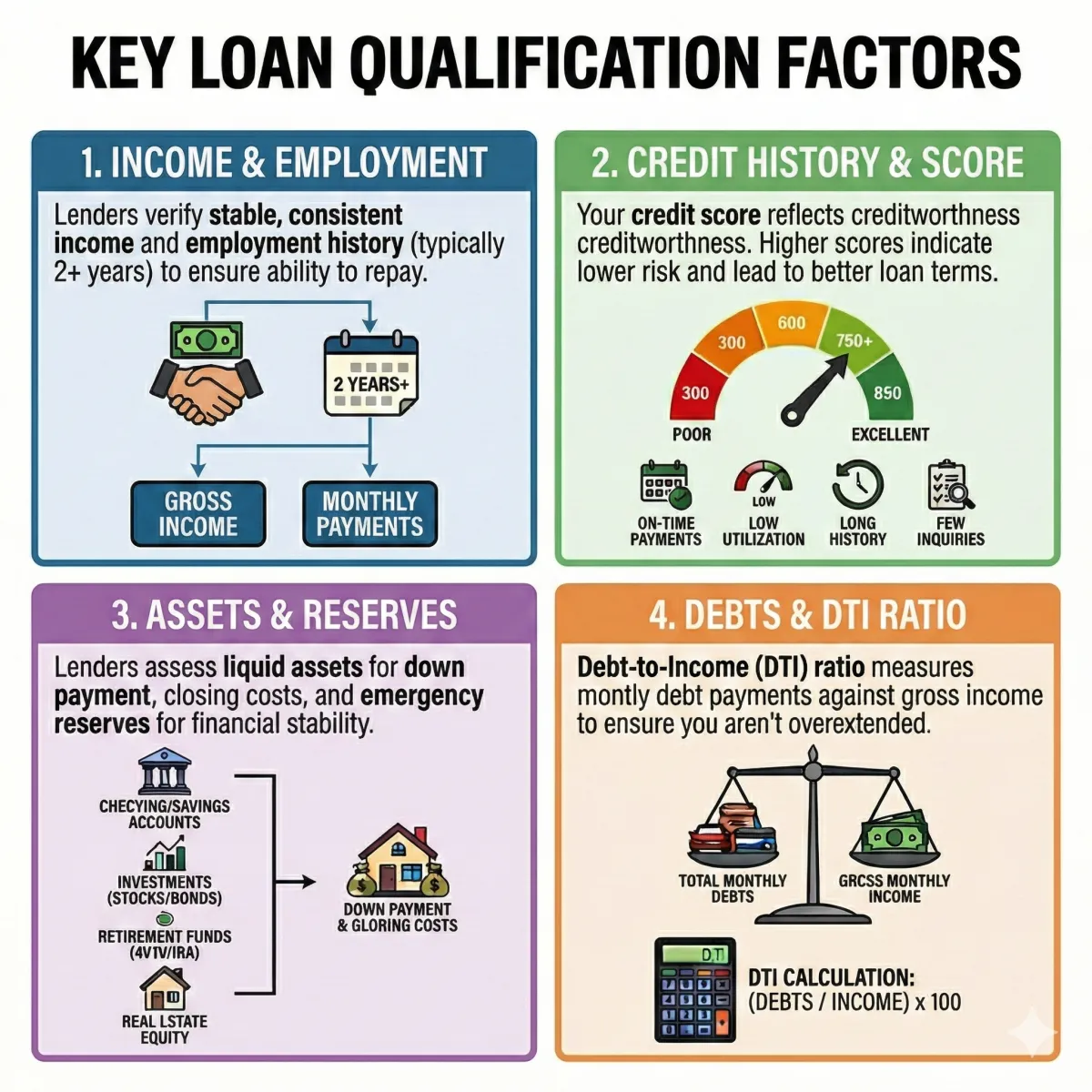

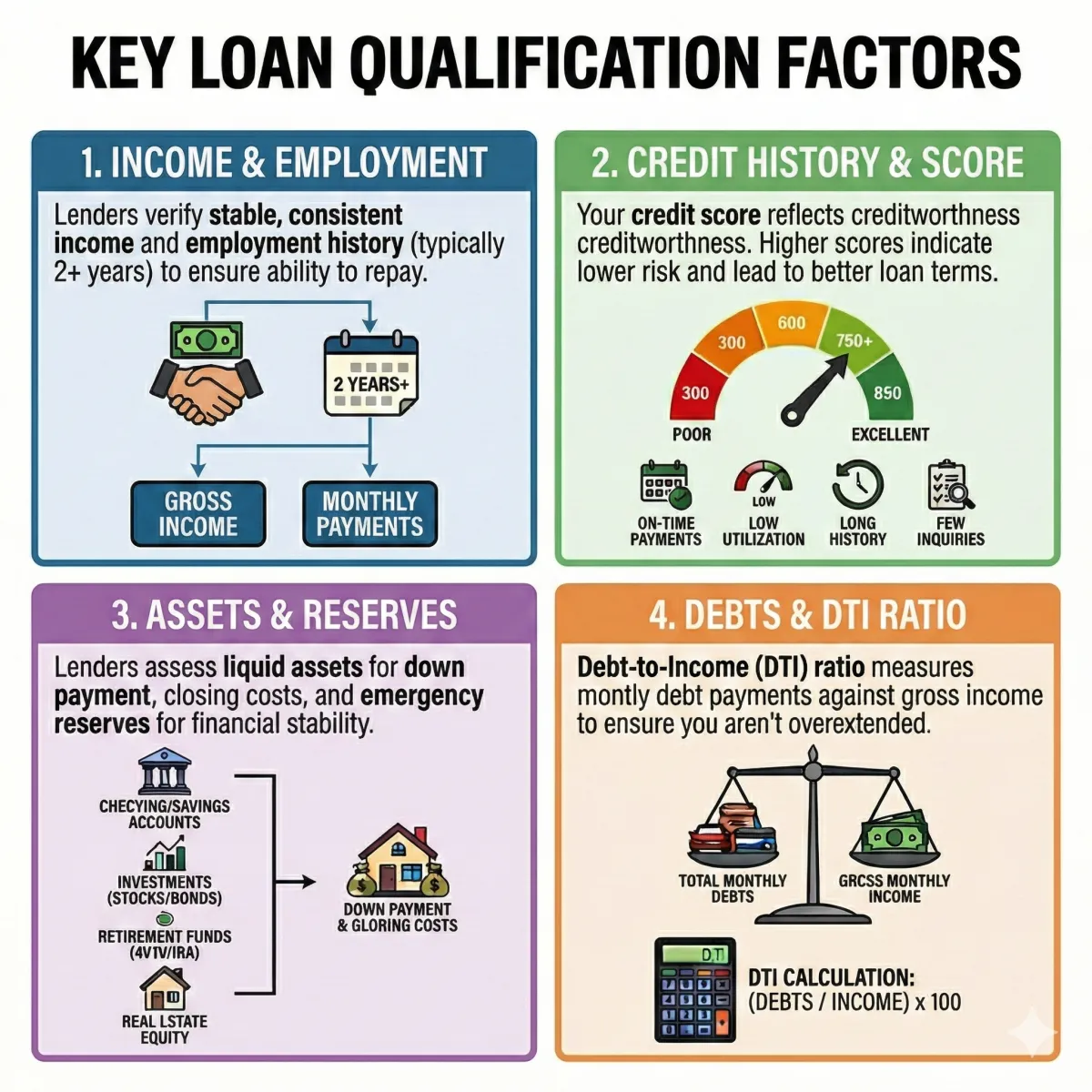

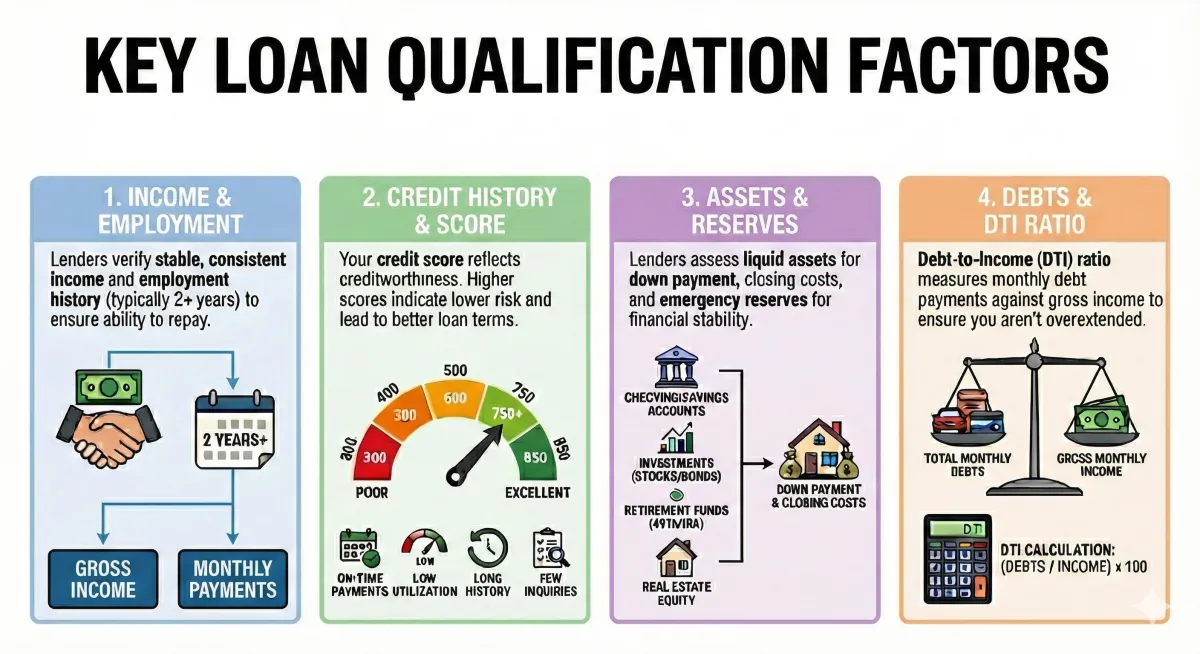

There are 4 important factors that lenders look at when they qualify you for a loan. These include: Income, Credit, Assets, and Debts. Let's break each one down.

*Information is for educational purposes only. I am a licensed Real Estate Agent, NOT a Mortgage Lender. Rates and terms are subject to change based on market conditions and credit approval. All scenarios are unique and must be run by a mortgage professional for more accurate information.*

Income + Employment History

Generally, lenders ask for 2 years of work/income history that is stable, reliable, and consistent. Here are additional notes:

W2 workers will need 2 years worth of W2's; 1099 workers will need 2 years of tax returns (and business tax returns if self employed)

Other types of acceptable income include but not limited to: disability income, VA disability income, pension, social security,etc.

Student history counts as "employment" history

Employment history at the SAME job for 2 years is not neccessarily required.

Credit

Different loans ask for different credit scores. Generally, the higher your credit score, the lower the interest rate you can obtain. Here are some additional notes:

740+ credit is considered excellent credit. You will get the best rates above this score.

620+ is required for conventional loans. (Though, most lenders may require a score closer to 660+)

580+ is required for FHA to get the 3.5% minimum down payment

500-580: 10% down is required for FHA

Below 500: credit needs to be worked on

Assets

When it comes to buying a home, you want to have money set aside to apply towards the purchase. Your biggest costs will be your down payment and closing costs (they are two separate things). Here are some additional notes:

Down Payment: The down payment is your initial investment in the home. Down payment requirements vary per loan. Some allow 0% down, others 3%, 3.5%, 10%, 20%, etc. Let's look at an example for a $400,000 home:

- 3.5% down with an FHA loan would be $14,000

- 20% down with a Conventional loan would be $80,000

Closing Costs: Closing costs are all other costs associated with the loan. They are typically anywhere from 3-5% of the loan amount and vary widely from transaction to transaction.

Debts

When it comes to debts, the most important factor lenders look at is your Debt-to-Income Ratio (DTI). Your DTI looks at how much of your total monthly income goes towards paying monthly debts. Each loan type has different DTI ratio maximums. Here are some additional notes:

For example, if you make $7,000 a month and have $2,000 in monthly debt, your DTI is 36% (2,000/7,000). The lower your DTI the better.

Monthly debts considered are ones usually pulled from a credit report, such as credit card payments, student loans, car payments, and other revolving/installment debts.

TESTIMONIAL

What My Clients are saying...

Iris Quinn

"If you need a realtor in the Atlanta area and more… Eduardo is the best of the best. He advises you but at the same time lets you be, listens your needs. He never says no! He is always there for you. He already help me to buy two properties. HE REALLY REPRESENTS YOU. He's a sweet package of knowledge, professionalism and kindness. All you need to buy or sell your home💙💜. Thank you Eduardo 🙏🏼."

Oliver Padilla

"I called Eduardo from a for sale sign I saw in a yard while house hunting. The house he was selling was already under contract, but he immediately helped us find similar properties in the area. He showed us several homes over the course of a month (33 houses to be exact) until we found the perfect home to fit my family's needs. By the time we finished working with Ed, he felt like family, we even invited him to our house warming party! All this to say, if you're looking for a agent to help you find a home, look no further! He is professional, courteous, and works harder than any agent i've worked with. Thanks again Ed!"

Eddie Arriaga

"Eduardo De La Riva is a great asset to have on your team when buying a new home, especially if it’s your first. He is very knowledgeable and will help make the process very smooth and also has connections to great people to help as well. Definitely recommend him to anyone looking for a realtor."

Anna & Patrick Smith

"This is the second home Ed sells for us and we are thrilled with the outcome! We recommend Ed to anyone looking to sell their home. Especially in Gwinnett county, he is an expert and will not disappoint!"

Nina & George Dimitrov

"Eduardo , thank you for finding us a buyer for our house on the second day!

Thank you for making the whole process from the beginning to the end very smooth and easy. You are such a wonderful person inside and out! We love you! Nina and George❤️💙"

Susan B.

"Working with Eduardo was an absolute pleasure. He made the entire selling process smooth and stress-free, guiding us every step of the way. His expertise and excellent communication gave us confidence from start to finish. Eduardo truly went above and beyond to ensure a successful closing, and we couldn’t be happier with the results. Highly recommend!"

FAQ

Frequently Asked Questions

Here are some common questions that my clients ask:

Do I owe any realtor commission as a buyer?

No, when you buy a home, we negotiate for the seller to pay my commission in full.

How long does the process take?

Most transactions take about 30 days to close. This is from the day we go under contract until the day we sign at closing.

What if something bad comes up on the inspection report?

If something concerning arises on the inspection report, you have many options. We can negotiate for the seller to repair those items, get a credit in lieu of them performing the repairs, or you can back out of the contract and receive your earnest money back while in the due diligence period.

What are the upfront costs associated with buying a home?

Your upfront costs will be the general inspection (roughly between $400-$600, not including add-on inspections) and appraisal (about $500-$700). Keep in mind, you will also need to send earnest money early in the process that is 1% of the purchase price.

Ready to Buy Your dream home?

Schedule a consultation with me below to start your home buying journey. Let's go!